The senators return to the senate for a record eighth time on Tuesday August 11, 2020 to try and reach an agreement on the contentious third basis for sharing revenue among the Counties. The Commission on Revenue Allocation submitted to the Senate the third basis for the financial years 2020/2021 to 2024/2025 on 30/04/19 for approval, the deliberations on this formula have turned into a protracted and divisive engagement.

This has caused delays in approval of the County Allocation of Revenue Act (CARA) 2020 meant to trigger disbursement of funds for FY 2020/21 from the National treasury to the counties. This standoff has resulted in disruption in delivery of services like healthcare to the extreme poor and vulnerable, delayed salaries and threatens to slow down the fight against Covid-19 pandemic.

What is the cause of this deadlock?

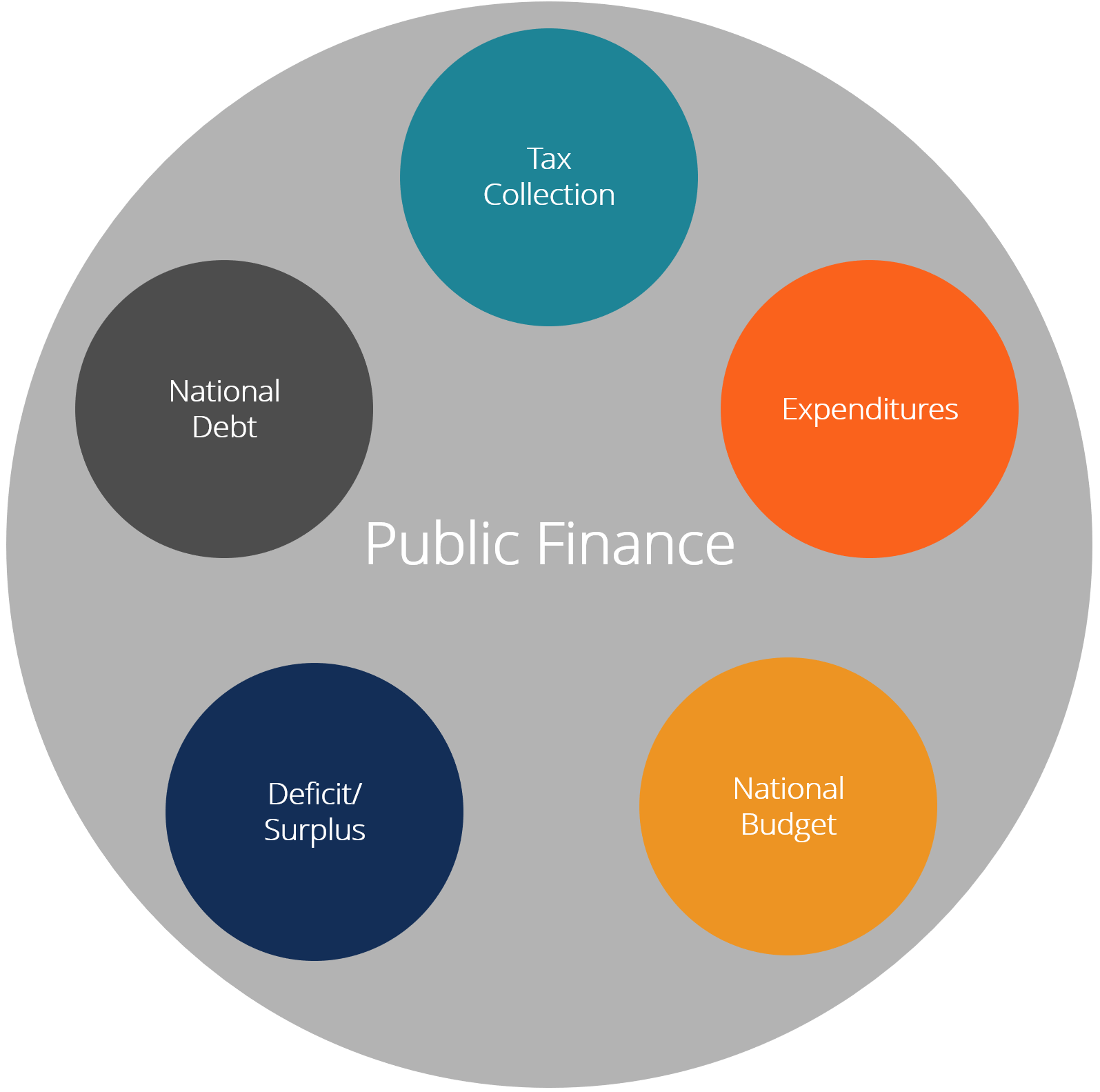

The new formula has varied the parameters and weights upon which the revenue is shared. In aggregate, it allocates 65 per cent of the revenue for enhancing delivery of public services, 31 per cent for promotion of balanced development, and 4 percent to incentivize revenue collection and fiscal prudence. Due to these changes, it has been perceived to reallocate funds from the poorer, less populated, and historically marginalized counties to relatively richer and more populated counties. Under the new formula, at least 17 counties have their revenues cut, some of the greatest losers include Wajir whose revenue will be cut by Sh.1.9 billion, Mandera (Sh1.8 billion), Marsabit (Sh1.8 billion), Garissa (Sh1.2 billion), Tana River (Sh1.5 billion), Mombasa (Sh1.6 billion), among others.

The top gainers include Kiambu (Sh1.3 billion), Nairobi (Sh1.2b), Uasin Gishu (Sh923m), Nandi (Sh788m), Kajiado (Sh765m), Nakuru (Sh744m), Laikipia (Sh660m, Trans Nzoia (Sh656m), Kirinyaga (Sh538m), Baringo (Sh537m), Bomet (Sh456m) and West Pokot (Sh444m). Senators rejected a proposal by the majority whip Sen. Irungu Kang‘ata to have the formula deferred to 2022/2023 to allow time for more resources going to the Counties to ensure no county loses funds.

On Tuesday, the Senators are expected to debate amendments proposed by Sen. Johnson Sakaja and Sen. Mithika Linturi. Sakaja proposes that the formula used for FY 2019/20 continue to apply for equitable share not exceeding Kshs. 316.50 billion and that the third-generation formula apply for equitable share and above Kshs. 316.50 billion. Linturi’s amendment is closely related to Sakaja’s but only lowers equitable share for which the second-generation formula will apply to between 250.00 billion and 270.00 billion. The exact amount is still under negotiation.

It should be remembered that the 316.5 billion available for counties in FY 2020/21 is the same amount received in FY 2019/20. The impact of Covid-19 is projected to worsen revenue collection beyond FY 2020/21 dampening hopes for more revenue in the next FY. The senators should consider the effect of new data. For example, new population data has shifted from 2009 to 2019 census, poverty data from 2009 to 2015/16 Kenya Integrated Household Budget Survey (KIHBS), fiscal effort data from 2017/18 to 2018/19 revenue. Updating the parameters in second-generation formula results in some Counties losing funds and others gaining. Updating the population parameter results in at least 30 Counties getting less revenue while updating poverty and Fiscal Effort data results to 26 and 12 Counties having their revenue cut respectively. When all the parameters are updated, while holding the second basis for revenue sharing constant 27 counties with less revenue than they received during FY 2019/20.

In conclusion, the senators may not achieve their goal of ensuring that no County gets less funds than is currently receiving using the Sakaja’s and Linturi’s proposed amendments. In this context, the recommendation of the CRA for a phasing-in of the formula to avoid disruption in service delivery and development programs by setting aside 15 percent of the equitable share increment to cushion counties which would see a reduction in their equitable share in a quantum in excess of 5 percent is more persuasive.

This approach ensures that County governments can perform their functions and guarantees stable and predictable allocations of revenue provided in article 203(d) and (j) of the Constitution. Counties should focus on strategies which enhance own source revenue generation to reduce overdependence on exchequer releases and ensure public funds are used in a prudent and responsible way.

https://www.nation.co.ke/kenya/blogs-opinion/opinion/-more-revenue-will-break-stalemate-1915166

Français

Français