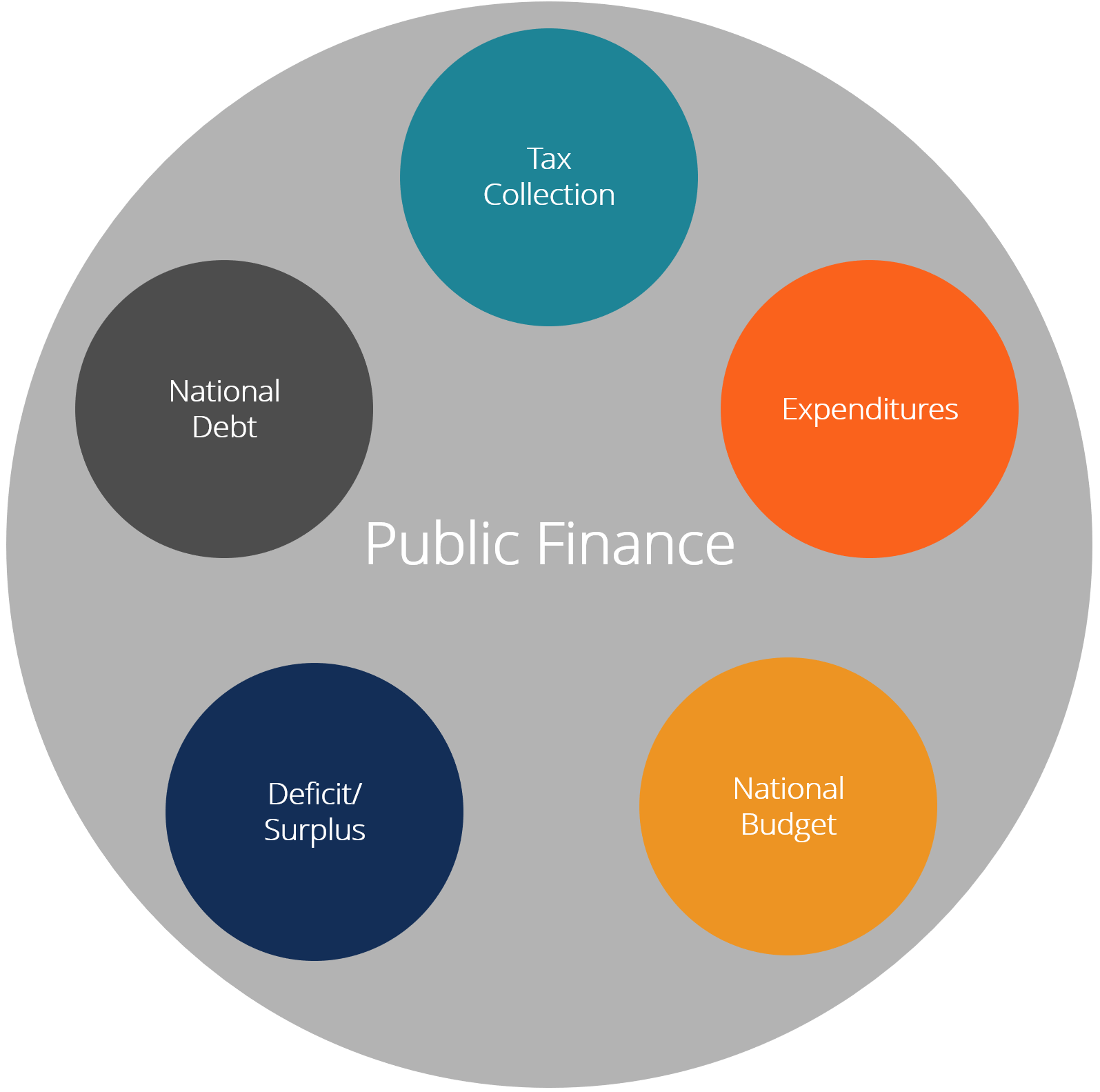

The famed American thief Willie Sutton was once asked why he robbed banks. “Because that’s where the money is!” was his laconic response. Today, many countries want to tax the super-rich for the same reason. But doing so has proven to be no easier than robbing a bank. Some countries have managed to make more progress than others, however. Uganda reformed its approach to taxing high net worth individuals (HNWIs) in 2015 and within three years, filing of tax returns by HNWIs increased from 13 percent to 78 percent. Tax revenue from this segment also increased, from Ush 19.7 billion in FY2014/15 to Ush 106.9 billion in FY 2021/22.

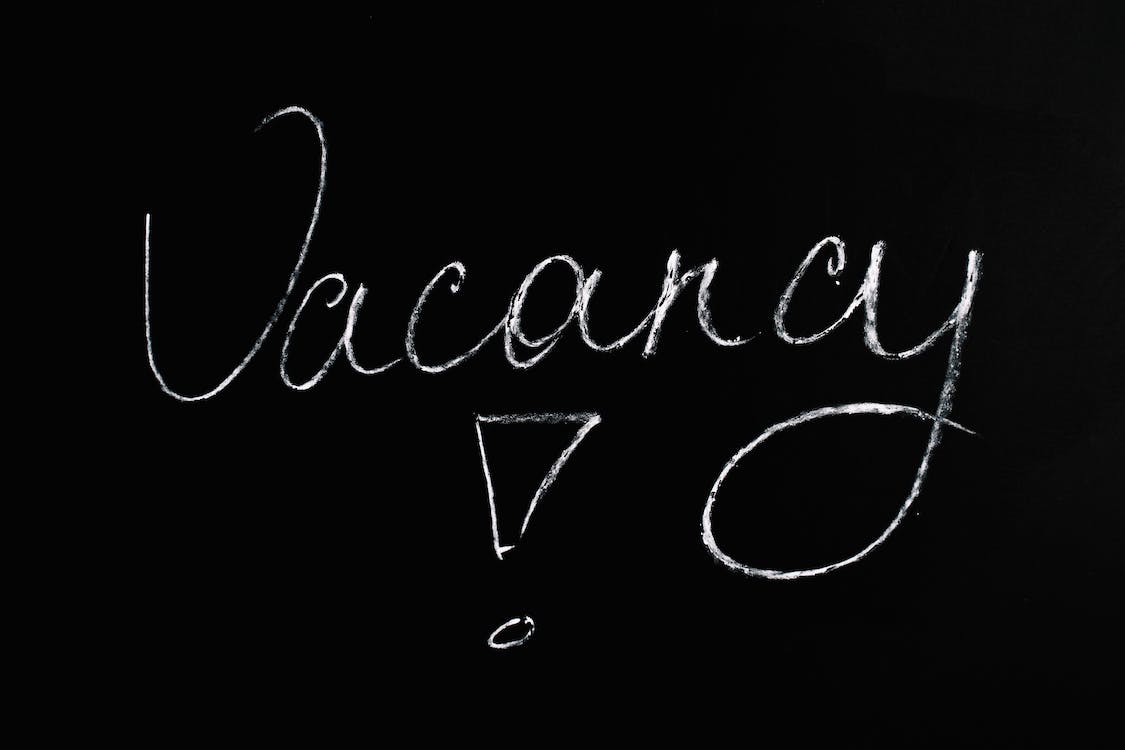

While this increase in revenue is modest, Uganda’s experience provides evidence that taxing HNWIs is possible. As Kenya grapples to increase revenues, it should follow the Ugandan approach and set up a special unit to focus on taxing HNWIs, actively engage with taxpayers, use available information on the wealthy opportunistically rather than trying to be comprehensive, and focus on taxpayer education. With political commitment from the top of the revenue authority, such reforms can lead to real revenue gains.

The idea of taxing the rich is not new in Kenya. Kenya’s Vision 2030 proposed various tax reforms, including taxation of HNWIs. This would be achieved through interventions such as exchange of tax information with other countries. The Kenya Revenue Authority (KRA) 8th Corporate Plan also recognizes HNWIs taxation as a key source of revenue but little progress has been made in actually taxing them.

By contrast, Uganda created a dedicated unit to tackle HNWI taxation back in 2015. Uganda initially had two different units tracking HNWIs and VIPs. Because VIPs were high net worth, politically influential, and very busy, they were similar to HNWIs, so tax officials needed similar skills to engage them. Uganda also recognized that HNWIs were different from large corporations, so the HNWI/VIP tax unit was separated from the Large Taxpayers Office (LTO). This is considered a good international practice: the International Monetary Fund (IMF) argues that dedicated HNWIs units are vital to improve customer service, understand taxpayers, and manage compliance risks effectively.

Several additional factors have contributed to the success of Uganda’s HNWI unit. First, active engagement and commitment from Uganda Revenue Authority’s (URA’s) top management played a crucial role in the decision to tax HNWIs. Second, URA focused on taxing HNWIs it could identify easily, starting with publicly available information to generate a list of possible HNWIs. Only later would Uganda develop a formal criterion for identifying HNWIs. Third, a close collaboration between the HNWI unit and the URA’s research division ensured that the unit’s approach was evidence-based. Moreover, HNWI unit staff were picked based on their communication skills; it was crucial for these staff to balance assertiveness and respectfulness to effectively handle HNWIs and communicate tax matters in a simplified way. Lastly, the HNWIs unit initially focused on tax education to gain their commitment to pay taxes, rather than solely resorting to harsh enforcement measures.

While Uganda’s case exemplifies good practices, it is also a cautionary tale, as improved HNWI tax compliance did not result in a significant increase in revenue. This segment of taxpayers is known for aggressive tax planning. Because most of their income is from assets whose residency is spread across many jurisdictions, it is challenging for a single country to effectively tax HNWIs.

This suggests that international collaboration through exchange of information and effective use of data is a core element in successful taxation of HNWIs. Being a signatory of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters, Kenya can leverage on information acquired to effectively tax HNWIs. Kenya can also learn from other countries that have successfully implemented voluntary disclosure programs to address non-compliance .

In conclusion, Kenya should follow Uganda’s lead and establish a dedicated HNWI unit separate from the Large Taxpayers Office (LTO). Taxing HNWIs efficiently necessitates a balanced strategy that includes teamwork, openness, and targeted policy measures. It would also be critical to build the technical skills of the HNWI unit to address tax evasion more effectively. KRA should assess Kenya’s legal framework for taxing HNWIs, given the complexity of their financial planning, potentially requiring a specialized workforce to handle complex tax issues and related litigation.

Author: Veronicah Ndegwa, Senior Research Analyst- Tax Policy and Public Debt

Français

Français